Bank Guarantees Made Simple: How They Work and How to Get One

Introduction

Bank guarantee are commonly used by businesses to secure transactions, as they provide financial assurance and reduce risk. In essence, a bank guarantee serves as a formal promise from a financial institution, ensuring payment or performance if one party defaults. As a result, companies confidently rely on bank guarantees across various commercial deals.

Moreover, bank guarantee play a vital role in protecting interests within contractual agreements. For this reason, understanding how bank guarantees work helps firms manage financial and operational risks more effectively. Additionally, they strengthen trust between trading partners and enhance business credibility.

In this article, the concept of bank guarantees is explained clearly and simply. Furthermore, it explores the different types of bank guarantees, why businesses need them, and how they function in real-world transactions. Most importantly, readers will learn how to acquire a bank guarantee efficiently, thereby making informed decisions that support business growth and security.

Definition and Purpose of Bank Guarantee

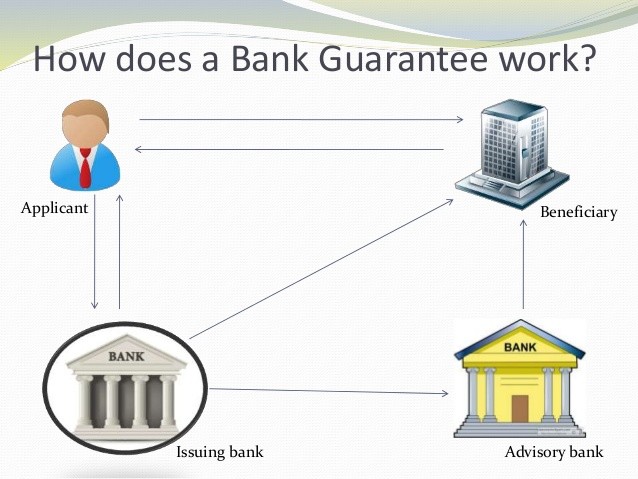

Banks issue guarantee to back contractual obligations by providing financial security. Essentially, a bank guarantee acts as a formal commitment in which the bank agrees to pay if the applicant fails to meet agreed terms. Consequently, this financial tool strongly supports trade transactions and large-scale projects.

Moreover, bank guarantees help build trust between parties involved in a contract. For example, sellers often require guarantees from buyers to ensure payment upon delivery. As a result, business relationships become more secure and reliable.

The primary purpose of a bank guarantee is risk mitigation. In other words, it helps parties avoid financial losses caused by non-performance or default. Before issuing a guarantee, banks carefully assess the applicant’s creditworthiness. During this process, applicants may be required to pay fees and provide collateral.

Importantly, bank guarantees differ from letters of credit. While letters of credit facilitate direct payment for goods or services, bank guarantees activate only in the event of default. Therefore, they serve as a secondary layer of protection rather than a payment mechanism.

Furthermore, businesses rely on bank guarantees for international trade, while domestic transactions also benefit significantly. Overall, bank guarantees provide essential protection, enhance transactional confidence, and support sustainable business growth.

Types of Bank Guarantees Explained for Businesses

There are several types of bank guarantees designed to meet different commercial and financial needs. Understanding these options allows businesses to select the most suitable guarantee for their transactions and contractual obligations.

Performance Guarantee

To begin with, a performance guarantee ensures that a contractor or service provider fulfills the terms of a contract. If the performer defaults, the bank compensates the beneficiary. As a result, project owners reduce execution risk and gain financial protection.

Bid Guarantee (Tender Guarantee)

Similarly, bid guarantees play a critical role in tender and bidding processes. Specifically, they confirm the bidder’s seriousness and financial capability. Consequently, project owners are protected from non-serious or withdrawn bids.

Advance Payment Guarantee

In addition, advance payment guarantees protect prepayments made before project execution begins. If the recipient fails to perform, the bank refunds the advance amount. Therefore, buyers and employers can release upfront funds with confidence.

Retention Money Guarantee

Likewise, retention money guarantees cover funds withheld during a project to ensure proper completion. Once the project is finalized, the bank releases the retained amount. This approach improves cash flow for contractors while maintaining security for the employer.

Financial Guarantee

Furthermore, financial guarantees address direct monetary obligations. For example, they may cover loan repayments, lease payments, or other financial commitments. In such cases, the bank ensures payment if the applicant defaults.

Deferred Payment Guarantee

At the same time, deferred payment guarantees support installment-based transactions. If scheduled payments are missed, the bank steps in to meet the obligation. This type is especially useful in trade finance and capital equipment purchases.

Choosing the Right Bank Guarantee

Ultimately, each type of bank guarantee serves a specific purpose and business scenario. Therefore, companies must assess contract terms, risk exposure, and transaction structure before selecting a guarantee. In conclusion, understanding the different types of bank guarantees helps businesses manage risk effectively, improve trust, and support both domestic and international trade.

Situations Where Bank Guarantees Are Required

Certain business situations demand the use of bank guarantees to ensure security and performance. Most notably, construction projects often require bank guarantees. In such cases, contractors provide performance guarantees to assure timely and satisfactory project completion.

In international trade, exporters frequently require payment guarantees from importers. This approach secures fund transfers and minimizes cross border payment risks. Likewise, government contracts commonly mandate bid guarantees. As a result, authorities are protected from frivolous or nonserious bids.

From a risk management perspective, businesses rely on bank guarantees to reduce financial exposure. Specifically, guarantees help prevent losses arising from default or non-performance. Moreover, they enhance business credibility, thereby increasing trust among partners and stakeholders.

Additionally, regulatory frameworks sometimes require bank guarantees in specific industries. For example, real estate developments often use retention guarantees to protect buyers’ interests until project completion. This ensures accountability and financial security throughout the development process.

Therefore, businesses should assess their needs early and identify scenarios where bank guarantees apply. By doing so, companies can prepare in advance, streamline operations, and execute transactions more efficiently.

Check out our last article on SBLC Monetization 2025: 7 Proven Steps for Fast Liquidity

Step by Step Acquisition Process

To acquire a bank guarantee, follow structured steps. First, identify the requirement by carefully reviewing the contract terms.

Next, approach a reliable bank and submit the required application forms. At this stage, provide complete business details and up to date financial statements.

Thereafter, undergo a credit assessment, during which the bank evaluates your repayment capacity. If required, offer suitable collateral to strengthen the application.

Subsequently, pay the issuance fees, which typically vary depending on the guarantee amount and duration.

Once approved, receive the bank guarantee document and promptly share it with the beneficiary.

Finally, monitor your obligations closely and ensure all terms are fulfilled to avoid any claims against the guarantee.

Common Misconceptions About Bank Guarantees

People hold several misconceptions. One assumes guarantees equal loans. However, guarantees activate conditionally.

Another thinks they cost nothing. Fees and collaterals apply always.

Some believe banks issue them easily. Strict assessments occur.

Additionally, confusion with insurance exists. Guarantees differ in coverage.

Clarify these to avoid errors. Education prevents misuse.

Consider a supplier exporting goods. The buyer requires a payment guarantee. The supplier approaches their bank.

The bank issues a guarantee for $100,000. This covers default risks.

The deal proceeds smoothly. No claim arises.

This example shows practical use. It highlights benefits in trade.

FAQ

What is a bank guarantee?

A bank guarantee promises coverage by a bank if default occurs.

How does a bank guarantee differ from a letter of credit?

Guarantees activate on default, while letters facilitate direct payments.

What types of bank guarantees exist?

Types include performance, bid, advance payment, and financial guarantees.

How long does it take to get a bank guarantee?

It takes from a few days to several weeks, depending on assessments.

Can small businesses obtain bank guarantees?

Yes, small businesses qualify with strong financials and collateral.

Are bank guarantees expensive?

Costs involve fees, but they provide valuable protection.

Bank guarantees offer critical support in transactions. They cover definitions, types, and processes. Businesses secure them step by step. Avoid misconceptions for better use. Examples and

Don’t miss out on securing your deals today. Contact TRG Venture Capital International Investment G.P. Limited now for expert guidance on bank guarantees. Reach us at info@trgventurecapital.com to start protecting your investments without delay.