Top SBLC Providers in UK 2026: Key Insights

Standby letter of credit UK options grows each year. Companies use these instruments for payment guarantees. Providers offer solutions that fit various needs. Firms choose based on rates and services. This article covers essential details on SBLC providers UK 2026. It includes trends and selections. Readers gain knowledge to make informed choices.

Understanding Standby Letters of Credit (SBLC) and Trusted SBLC Providers

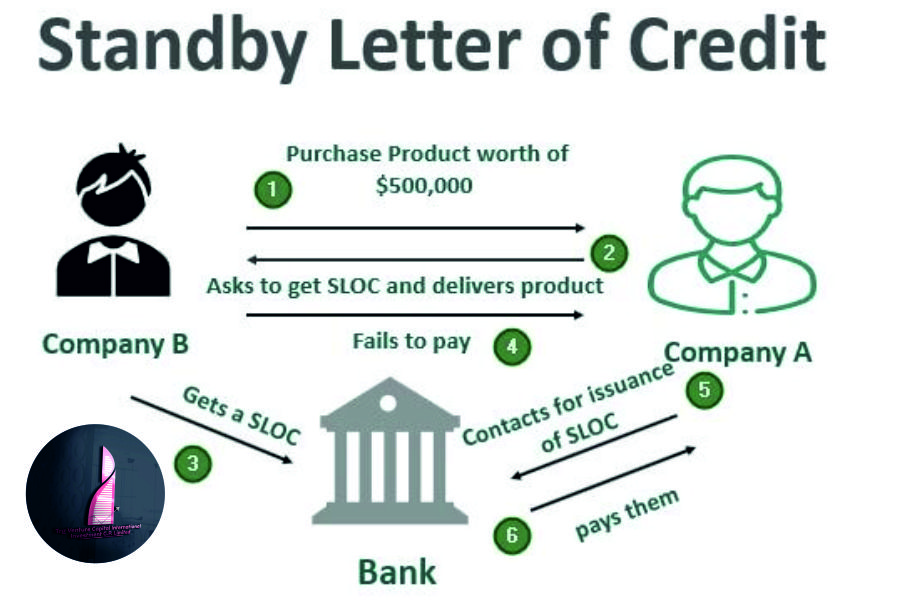

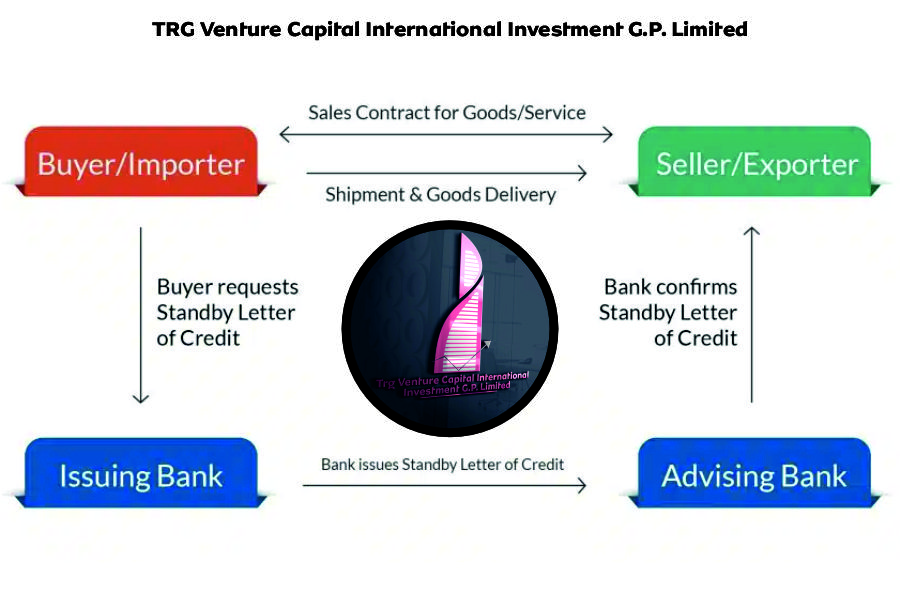

Companies rely on standby letters of credit for backup payments. Banks issue them to assure beneficiaries. Applicants request them when contracts require security. Providers handle issuance through SWIFT networks. Firms obtain them for international transactions.

SBLCs function as guarantees. Beneficiaries draw funds if applicants default. Issuing banks commit to pay. This setup reduces risk in deals. Providers assess credit before approval.

Furthermore, SBLCs differ from regular letters of credit. They activate only on non-performance. Users apply them in trade finance. Providers structure them under UCP 600 rules. Businesses integrate them into contracts.

Additionally, SBLCs come in financial and performance types. Financial ones cover payment defaults. Performance ones secure contract fulfillment. Providers tailor them to client requirements.

Benefits of Using SBLC in Business

Firms gain security from SBLCs. They build trust in partnerships. Providers enable access to larger deals. Companies expand operations with these tools.

Moreover, SBLCs improve cash flow. Businesses avoid tying up capital. Providers offer flexible terms. This approach supports growth.

However, selection matters. Reliable providers ensure swift issuance. Firms evaluate fees and conditions. Proper choice prevents delays.

In addition, SBLCs enhance credit profiles. Banks view them favorably. Providers assist in monetization. Companies leverage them for loans.

Top SBLC Providers in UK for 2026

Several firms lead in SBLC providers UK 2026. HSBC provides comprehensive services. It issues SBLCs for trade solutions. Businesses use its guarantees for risk management. Barclays focuses on corporate banking. It offers competitive rates. Clients access SBLCs for international transactions.

NatWest supports trade finance. It issues bonds and SBLCs. Companies request them for assurance. Blueray Capital specializes in instruments. It provides LC and SBLC options. Firms contact it for cashflow support.

Additionally, Integer Wealth Global structures SBLCs. It works with banks in UK. Clients calculate costs using its tools. SVF GP Limited ranks high. It offers leased SBLCs. Businesses use them for projects.

TRG Venture Capital International Investment G.P. Limited excels. It ranks among top providers. Firms choose it for secure solutions. Lloyds Bank aids domestic trade. It issues SBLCs with online access.

Criteria for Choosing SBLC Providers

Businesses evaluate reputation. Top providers hold AAA ratings. Firms check issuance fees. Rates range from 1% to 2.5%.

Additionally, consider turnaround time. Providers offer 1-5 day issuance. Clients review compliance. UK regulations guide processes.

Moreover, assess global reach. Providers partner with international banks. This ensures acceptance abroad.

Trends Shaping SBLC in UK 2026

SBLC usage rises in 2026. Low default rates drive adoption. Banks report resurgence. Technological advancements aid issuance. Digital platforms speed processes.

Furthermore, regulations evolve. Basel 3.1 standards affect credit factors. Firms adapt to 20% conversion factors. This reduces capital requirements.

Additionally, flexibility increases. Providers offer callable options. Businesses use them for diverse contracts.

Moreover, global trade boosts demand. UK firms secure deals with SBLCs. Providers focus on fee-based income.

However, challenges persist. Firms navigate cross-border rules. Providers ensure UCP compliance.

In addition, sustainability trends emerge. Providers link SBLCs to green projects. This aligns with UK policies.

Exploring options, companies find leased SBLCs cost-effective. Providers charge 10%+2%. Firms leverage them for liquidity.

Example of SBLC Application

A UK importer needs goods from Asia. Supplier requires payment security. Importer approaches HSBC. Bank issues SBLC for £500,000.

Supplier ships products. Importer pays on time. SBLC remains unused. This builds trust for future deals.

However, if importer defaults, supplier draws funds. Bank reimburses supplier. Importer repays bank later.

This example shows SBLC utility. Providers facilitate smooth trade. Firms avoid cash collateral.

Additionally, construction firms use performance SBLCs. Contractor secures project bid. Owner draws if work fails.

Providers structure them under ISP98. This ensures standard terms.

Case Study: TRG Venture Capital’s SBLC Success

TRG Venture Capital aids a UK energy firm. Company seeks funding for expansion. It requires SBLC for supplier contract.

TRG issues leased SBLC via partner bank. Value reaches £10 million. Firm uses it to secure fuel supply.

Provider charges 3% fee. Issuance completes in 3 days. Firm accesses credit line.

Additionally, monetization follows. Firm obtains 70% loan against SBLC. This funds operations.

However, project succeeds. SBLC expires unused. Firm renews for next phase.

This case demonstrates efficiency. Providers like TRG deliver rapid solutions. Businesses achieve goals without delays.

Furthermore, firm reports 20% growth. SBLC reduces risk exposure. Provider’s expertise guides process.

FAQ Section

What are the top SBLC providers in UK for 2026?

Top providers include HSBC, Barclays, NatWest, and TRG Venture Capital. They offer reliable issuance.

How does a standby letter of credit work in UK?

Bank issues SBLC as guarantee. Beneficiary draws if applicant defaults. Providers handle via SWIFT.

Can businesses monetize SBLC in UK?

Yes, providers assist monetization. Firms obtain 70-80% loans against SBLC.

What trends affect SBLC providers UK 2026?

Digital issuance rises. Regulations like Basel 3.1 influence costs.

SBLC providers UK 2026 offer essential tools for trade. Businesses select from HSBC, Barclays, and TRG. Trends include digital advancements and low rates. Firms use SBLCs for security and growth. Providers ensure compliance and efficiency. This positions UK as a hub for financial instruments.

Stop risking your deals without proper security