INTRODUCTION TO LOAN BG SBLC

Businesses often search for loan BG SBLC without upfront payment options to secure funding. However, such offers frequently lead to scams. TRG Venture Capital International Investment G.P. Limited provides legitimate bank guarantee and standby letter of credit services. Clients access these instruments through standard procedures. This approach ensures compliance and risk management. Understanding the realities helps avoid pitfalls. Loan BG SBLC without upfront payment claims promise quick access, but they ignore industry norms. Banks require fees and collateral for issuance. TRG guides clients through the process professionally.

Understanding Bank Guarantees

Bank guarantees serve as commitments from banks. They cover obligations if clients default. Companies use them in trade and projects.

Definition and Purpose

A bank guarantee assures payment or performance. It protects parties in contracts. For instance, suppliers demand them to confirm buyer reliability. Banks issue these after due diligence. Without collateral, issuance does not occur. TRG assists clients in obtaining them efficiently.

Types of Bank Guarantees

Performance guarantees ensure contract fulfillment. Payment guarantees cover financial dues. Advance payment guarantees refund prepayments if needed. TRG offers various types based on client needs. Each type requires specific documentation.

Additionally, tender guarantees support bids. They demonstrate seriousness in proposals. Retention guarantees hold funds until completion.

Exploring Standby Letters of Credit

Standby letters of credit function as backup payments. Banks issue them for international trade. They activate only upon default.

Key Features and Uses of Loan BG SBLC

This instrument guarantees payment to beneficiaries. It applies in cases of non performance. Unlike regular letters of credit, it remains dormant unless triggered. Businesses leverage it for secure transactions. TRG provides SBLC through top banks. The process involves swift messaging.

Furthermore, it supports loan repayments. Exporters prefer it for risk reduction.

Differences Between BG and SBLC

BG covers broad obligations, while SBLC focuses on payment. BG allows transfer, but SBLC does not. Companies choose BG for flexibility. SBLC suits specific trade deals. TRG explains these distinctions to clients. Selecting the right one depends on transaction type.

In contrast, BG often appears in construction. SBLC dominates in exports.

The Myth of No Upfront Payment in Loan BG SBLC Transactions

Claims of loan BG SBLC without upfront payment attract many. However, banks mandate fees for processing. These cover legal and administrative costs. Without them, providers expose themselves to risks. TRG insists on standard payments. This practice aligns with regulations.

Why Banks Require Fees for Loan BG SBLC

Issuance involves compliance checks. KYC and AML protocols demand resources. Banks charge for swift transmissions. Collateral secures the instrument. Skipping fees signals potential fraud. TRG upholds these requirements.

Moreover, insurance and stamp duties add costs. Providers pass them to clients.

Risks of “No Upfront” Loan BG SBLC Offers

Pursuing no fee deals often results in losses. Scammers promise quick issuance. They vanish after initial contacts. Businesses waste time and money. TRG warns against such traps. Legitimate services prioritize transparency.

Common Scams in Financial Instruments

Fraudsters exploit demand for BG and SBLC. They use fake documents and promises.

Fake Deeds of Agreement

Scammers present endorsed agreements. Banks do not endorse them. Clients fall for forged signatures. TRG verifies all documents thoroughly.

Misuse of Bank Payment Undertakings

Fraud involves invalid undertakings. Banks avoid them for liability reasons. Recognizing this prevents issues.

Unrealistic Procedures

Demands like provider moves first ignore norms. Banks reject them. TRG follows industry standards.

How TRG Provides Legitimate Services

TRG Venture Capital International Investment G.P. Limited specializes in trade finance. We offer BG and SBLC from global banks. Clients receive transparent processes.

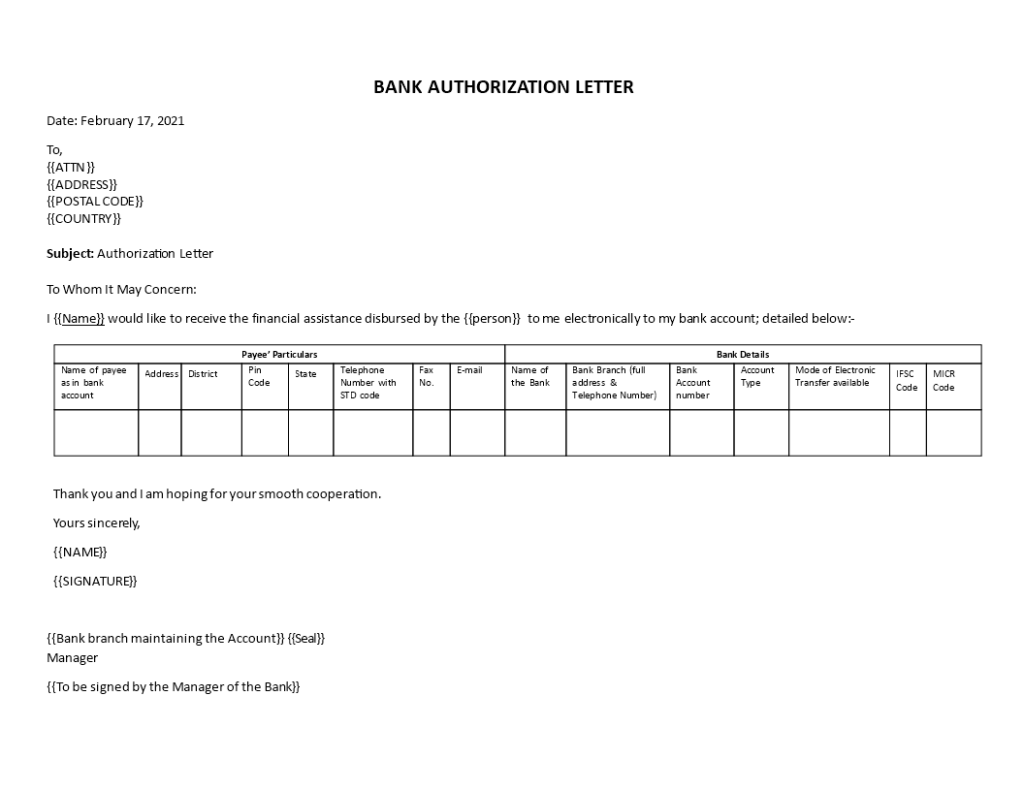

Application Process at TRG

Submit requirements first. Provide collateral details. Pay necessary fees. TRG handles bank coordination. Issuance follows approval. This ensures efficiency.

Therefore, clients gain quick access.

Benefits of Working with TRG

Secure transactions build trust. Reduced risks support growth. TRG’s experience spans years. Clients benefit from expert guidance.

To learn more about standby letters of credit, review this resource from Investopedia.

Example

A manufacturing firm needed funding for expansion. They sought loan BG SBLC without upfront payment online. Scammers offered quick SBLC. The firm paid small fees initially. Fraudsters disappeared. Losses reached $50,000. Turning to TRG, they secured legitimate BG. It required collateral and standard fees. The project succeeded. This example shows the dangers.

Check out our last article on Bank Instrument Failures: Stop Them – Top 9 Reasons Exposed

Monetization Options for Instruments

BG allows transfer and monetization. Third parties can leverage them. SBLC restricts this. TRG advises on viable options.

Steps for Monetization

Identify buyers first. Provide instrument details. Negotiate terms. TRG facilitates connections.

Requirements for Obtaining BG or SBLC

Collateral forms the base. Financial statements support applications. Compliance documents are essential.

Documentation Needed

Business registration papers. Proof of funds. Contract details. TRG reviews them.

Transitioning to Secure Financing

Moving from myths to facts empowers decisions. TRG stands ready to assist.

FAQ Section

What is a bank guarantee without upfront payment?

It refers to claims offering BG issuance without fees. However, legitimate providers require them for costs.

Can I get SBLC without collateral?

No, banks demand collateral to manage risks.

How does MT760 work in BG issuance?

It transmits the guarantee via SWIFT network.

What are the differences between BG and SBLC?

BG is transferable and covers performance. SBLC focuses on payment and is non-transferable.

Why avoid loan BG SBLC without upfront payment offers?

They often lead to scams and financial losses.

Is monetization possible for SBLC?

No, due to non-transferability.

Loan BG SBLC without upfront payment remains a common search. Reality shows banks require fees and collateral. Scams prey on uninformed businesses. TRG Venture Capital International Investment G.P. Limited delivers legitimate solutions. Clients secure instruments through standard processes. This builds trust and enables growth. #BankGuarantee #SBLC #TradeFinance #FinancialInstruments

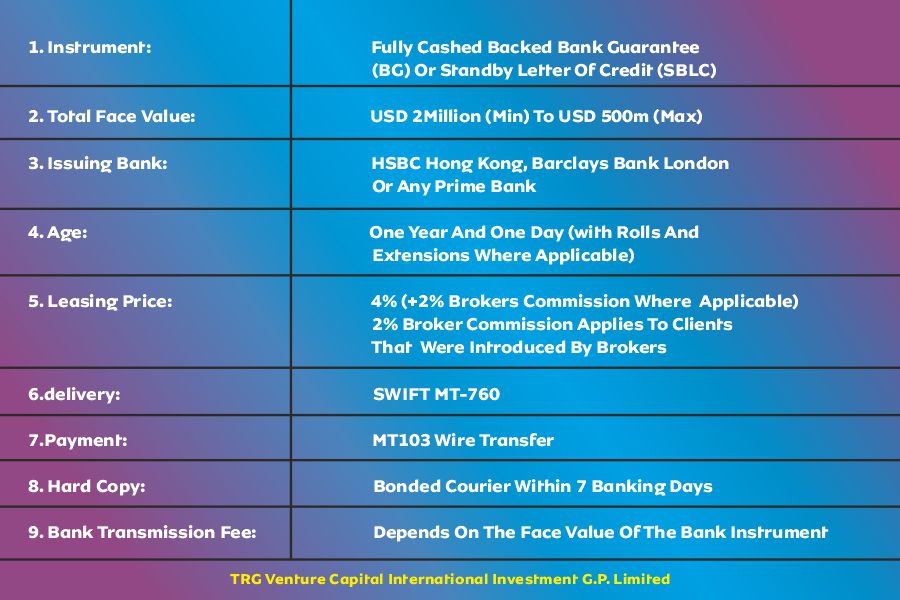

BELOW IS THE DESCRIPTION OF LEASE BANK INSTRUMENTS (BG/SBLC/SLOC)

TRG Venture Capital International Investment G.P. Limited offers a simple and transparent SBLC monetization settlement method using the global SWIFT Network System.

First, the Standby Letter of Credit (SBLC) is delivered bank to bank via SWIFT MT799. Then, once verification is completed, it is followed by SWIFT MT760 for final issuance.

As a result, this structured process ensures security, authenticity, and full compliance with international banking standards. Moreover, using the SWIFT network reduces risk, improves transaction speed, and builds trust between all parties.