Top SBLC Providers in the UK Today

Today, businesses actively seek reliable SBLC providers in the UK for secure trade finance solutions. In fact, standby letters of credit issuers in the United Kingdom offer essential guarantees that support global commerce. Moreover, companies use these financial instruments to facilitate international transactions with confidence and transparency. Additionally, providers include both major banks and specialized firms such as TRG Venture Capital International Investment G.P. Limited. As a result, these entities ensure payment obligations are met in case of default, thereby minimizing risk exposure.

However, selecting the best SBLC provider in the UK requires careful evaluation of each firm’s reputation, service quality, and contractual terms. Therefore, TRG Venture Capital International Investment G.P. Limited assists clients throughout this process, ensuring reliable and compliant SBLC issuance that supports long term international trade success.

Understanding Standby Letters of Credit

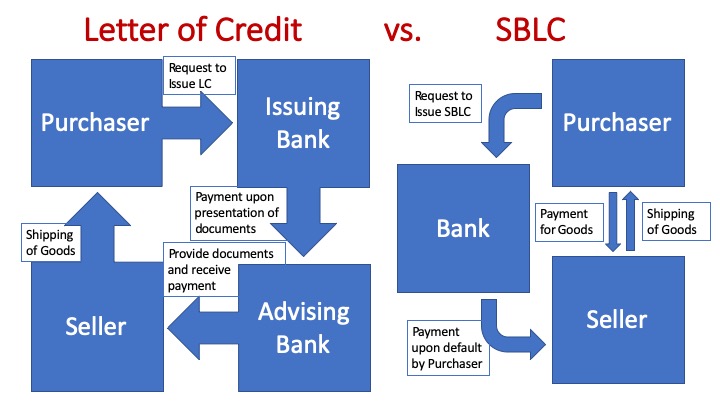

Companies commonly rely on standby letters of credit (SBLCs) as backup payment guarantees in international trade. Essentially, banks issue these instruments on behalf of clients to ensure contractual performance. If the applicant fails to meet agreed obligations, the beneficiary automatically receives funds. In this way, SBLCs protect sellers from default while buyers benefit from deferred payment flexibility. Therefore, many trading parties incorporate SBLCs into their deal structures to enhance financial security.

Typically, banks transmit SBLCs through SWIFT MT760 messages, which ensures document authenticity and traceability. Moreover, providers charge fees based on the risk profile and transaction amount. To apply, businesses usually work through their relationship managers, and approval depends primarily on creditworthiness. Once approved, the SBLC remains active until its expiry date or drawdown.

It is important to note the differences between standby letters of credit and regular letters of credit. While standard LCs facilitate primary payments, SBLCs only activate in cases of default. For further insights, visit Investopedia’s detailed explanation of standby letters of credit.

Finally, evaluating SBLCs requires careful attention to contractual terms. Because providers customize wording to match specific agreements, businesses must ensure compliance with UCP 600 rules, or in some cases, ISP98 standards. Therefore, consulting trade finance experts helps companies navigate these frameworks effectively and avoid costly misinterpretations.

Criteria for Selecting Top SBLC Providers

When selecting top SBLC providers, businesses must evaluate several important factors to ensure reliability and compliance. First and foremost, reputation ranks among the highest priorities. In general, established banks and financial institutions offer greater stability and credibility. Moreover, their extensive global networks facilitate seamless cross-border transactions, which is essential for international trade.

Secondly, fees play a significant role in the decision-making process. Although providers charge issuance costs and commissions, it is wise to compare rates across multiple options. However, lower fees do not always guarantee better service quality.

Thirdly, processing time matters considerably. For instance, quick issuance supports urgent trade transactions. While some providers deliver within days, others may take several weeks. Therefore, businesses should align timelines with operational needs.

In addition, customization options can vary widely. Top SBLC providers often offer flexible terms and tailor contract wording to meet specific business requirements. As a result, they ensure that each SBLC fits the transaction’s purpose precisely.

Furthermore, customer support remains a crucial criterion. Responsive teams resolve issues promptly, and access to dedicated relationship managers improves client satisfaction and efficiency.

Equally important, regulatory compliance ensures the validity and enforceability of issued SBLCs. Since providers must follow UK financial regulations, oversight by the Financial Conduct Authority (FCA) offers additional assurance of legitimacy.

Moreover, risk assessment capabilities also differ between providers. Strong SBLC institutions conduct thorough applicant evaluations, which lead to reliable and secure issuances.

In addition, integration with other trade finance services adds extra value. For example, banks often offer bundled solutions, combining SBLCs with letters of credit, guarantees, and export financing a structure that streamlines operations.

Recently, sustainability practices have also emerged as a selection factor. Some leading SBLC providers now prioritize green finance initiatives, aligning their products with modern corporate sustainability goals.

Finally, client feedback serves as an essential guide. Positive reviews and long-standing customer relationships usually indicate trustworthiness and reliability in SBLC issuance.

Top SBLC Providers in the UK: Leading Issuers and Specialists

Several entities stand out as top SBLC providers in the UK, offering reliable standby letters of credit for trade, investment, and project finance. Below is an overview of key players dominating the market in 2025.

HSBC

provides comprehensive standby letter of credit (SBLC) services for both trade and infrastructure projects.

Moreover, clients gain access to HSBC’s global expertise and strong compliance record.

The bank efficiently handles large transaction volumes, and its innovation banking arm supports startups and technology-driven ventures.

In addition, HSBC’s fees remain competitive, and processing times are relatively swift, making it a preferred choice for established corporates.

TRG Venture Capital International Investment G.P. Limited

TRG Venture Capital International Investment G.P. Limited ranks among the top standby letter of credit providers in the UK. Specifically, the firm specializes in leased and owned SBLCs for trade finance, project funding, and investment security.

TRG issues instruments from top-rated European banks within 5–7 business days, ensuring speed and reliability and flexible monetization options. All SBLCs are structured under UCP 600 and ISP98 standards, guaranteeing global acceptance.

TRG offers:

Performance, advance payment, and bid bonds fees starting at 1.5% per annum (no hidden charges)

24/7 advisory from its London-based trade finance team. In addition, TRG supports both SMEs and large corporates across energy, infrastructure, and commodities sectors.

The company also integrates SBLCs with private placement programs and bank guarantee monetization, positioning itself as a one-stop trade finance solution.

“TRG delivered a €25M SBLC in 6 days faster than any bank we approached.” CEO, UK Energy Firm

Barclays

Barclays offers SBLCs through its corporate banking division, primarily targeting UK-based enterprises.

Additionally, the bank provides tailored SBLC solutions integrated with digital tools for easier application and tracking.

Moreover, clients benefit from Barclays’ extensive international network, making it suitable for multi-jurisdictional trade operations.

Royal Bank of Scotland (RBS)

RBS delivers both standby letters of credit and bank guarantees for business clients.

Typically, the bank issues instruments under UCP 600 and ISP98 rules, ensuring standardization and legal protection.

Furthermore, RBS emphasizes quick amendments and strong customer support throughout the issuance process.

Lloyds Bank

Lloyds Bank supports SBLC issuance for domestic and international trade transactions.

Notably, the bank offers competitive rates and user-friendly online tracking portals.

In addition, Lloyds focuses heavily on SME financing and provides advisory support through dedicated relationship managers.

Standard Chartered

Standard Chartered excels in emerging markets, issuing SBLCs across Asia, Africa, and the Middle East.

Moreover, its global reach and cross-border experience make it ideal for import-export businesses.

Fees align closely with market standards, and processing integrates seamlessly through the bank’s digital trade platforms.

Deutsche Bank

Deutsche Bank operates an extensive SBLC portfolio in the UK, serving corporate and institutional clients.

Furthermore, it specializes in complex and high-value structures.

The bank’s global footprint supports cross-border transactions efficiently, and its service quality remains consistently high.

Citibank

Citibank London offers SBLC services for multinational corporations.

Additionally, the bank integrates SBLCs with treasury and liquidity management tools, providing real-time updates for clients.

Moreover, Citibank’s global coordination ensures swift issuance and strong international acceptance.

NatWest

NatWest, part of the RBS Group, provides SBLC solutions for UK businesses.

The bank offers flexible terms, prioritizes sustainability initiatives, and assigns dedicated advisors for personalized support.

Therefore, it appeals to SMEs looking for both flexibility and environmental responsibility.

Santander UK

Santander issues SBLCs for both domestic and international trade.

Furthermore, the bank emphasizes efficiency and competitive pricing, delivering dependable services for importers and exporters.

As a result, Santander remains a popular choice for growing UK enterprises.

Explore Investopedia’s guide for detailed insights on SBLC providers.

Real World Examples of How SBLC Providers Support UK Businesses

In practice, standby letters of credit (SBLCs) play a crucial role in supporting UK businesses.

For instance, a UK-based exporter uses an SBLC to secure a major machinery sale to a foreign buyer. Since the buyer requires a payment guarantee, the exporter approaches TRG Venture Capital International Investment G.P. Limited , one of the leading SBLC providers in the UK. The bank issues an SBLC worth £500,000, covering potential defaults.

As a result, the transaction proceeds smoothly. The buyer pays on time, and the SBLC expires unused.

This scenario demonstrates how SBLCs enhance trust, reduce risk, and help exporters secure contracts more easily.

In another example, a UK construction firm bids on a large infrastructure project. Since the client demands performance security, the firm obtains an SBLC from RBS.

Consequently, the company wins the bid, completes the project successfully, and the SBLC returns undrawn at project closure.

Ultimately, these examples highlight the practical benefits of standby letters of credit.

UK companies leverage SBLCs to build credibility, win contracts, and maintain financial confidence during transactions.

Therefore, selecting reliable SBLC providers in the UK such as or TRG Venture Capital International Investment G.P. Limited, HSBC, Barclays, RBS, ensures smooth, secure, and efficient trade operations.

FAQ About SBLC Providers in the UK

Standby Letters of Credit (SBLC) in the UK

What Defines a Standby Letter of Credit?

A standby letter of credit (SBLC) serves as a financial guarantee of payment if the applicant fails to fulfill obligations.

Banks and licensed SBLC providers in the UK issue these instruments to ensure that beneficiaries receive payment in case of default.

How Do Businesses Obtain an SBLC in the UK?

To obtain an SBLC, businesses apply through trusted SBLC providers or banks. They typically submit financial statements, contracts, and identification documents.

Afterwards, the provider performs credit checks and risk assessments before approval.

Can Small Businesses Access SBLCs?

Yes. Many banks and financial institutions, including Lloyds Bank and TRG Venture Capital International Investment G.P. Limited, offer SBLCs to SMEs.

Furthermore, requirements are often adjusted based on business size, turnover, and credit profile.

What Happens if an SBLC Is Drawn?

If an SBLC is drawn, the issuing bank or provider pays the beneficiary directly.

Subsequently, the applicant must reimburse the amount to the bank, which may impact their credit or future borrowing capacity.

Are SBLCs Transferable?

Yes, certain standby letters of credit allow for transfers to secondary beneficiaries.

However, transferability depends on the original SBLC terms.

Therefore, applicants should confirm this option with their provider before issuance.

In summary,

Top SBLC providers in the UK including TRG Venture Capital International Investment G.P. Limited, HSBC, Barclays, RBS, deliver vital trade finance solutions that secure transactions and strengthen business credibility.

Ultimately, selecting the right provider involves comparing fees, support quality, issuance speed, and global reach.

By doing so, businesses ensure smooth operations, reduced risk, and long-term financial stability in international trade.

Contact us today

At info@trgventure.capital or visit www.trgventure.capital for personalized SBLC solutions that empower your business growth.

Don’t miss the opportunity to secure your trade deals with confidence partner with TRG Venture Capital International Investment G.P. Limited today!